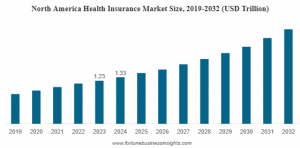

Health Insurance Market Size to Worth USD 4.45 Trillion by 2032 | Industry CAGR of 9.7% during 2025-2032

Key companies covered in health insurance market report are UnitedHealth Group, Elevance Health, Allianz, CVS Health, The Cigna Group, and Others.

PUNE, MAHARAHTRA, INDIA, February 19, 2025 /EINPresswire.com/ -- The global health insurance market size was valued at USD 2.14 trillion in 2024. The industry is expected to expand from USD 2.32 trillion in 2025 to USD 4.45 trillion by 2032, exhibiting a CAGR of 9.7% over the study period 2025-2032.Health insurance is a financial product designed to cover an individual's medical and surgical expenses. Different types of policies either reimburse costs incurred due to illness or injury or directly pay healthcare providers on behalf of the insured. The increasing incidence of various health conditions, a rising number of accidents and surgical procedures, and escalating healthcare costs are key factors driving the growing demand and adoption of health insurance policies in the market.

Fortune Business Insights™ offers these insights in its comprehensive research report titled “Health Insurance Industry Size, Share, Growth, and Forecast Report, 2025-2032.” The report provides an in-depth analysis of the Health Insurance Market, including detailed forecasts and trends shaping its growth over the coming years.

Get a Free Sample Research PDF:

https://www.fortunebusinessinsights.com/enquiry/sample/health-insurance-market-101985

➡️ Report Scope & Segmentation:

♦ Market Size Value in 2025: USD 2.32 trillion

♦ Market Size Value in 2032: USD 4.45 trillion

♦ Growth Rate: CAGR of 9.7% (2025-2032)

♦ Base Year: 2024

♦ Historical Data: 2019-2023

♦ Years Considered for the Study: 2019-2032

♦ No. of Report Pages: 149

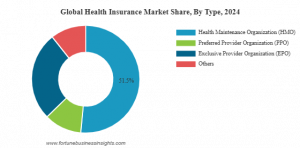

♦ 𝗦𝗲𝗴𝗺𝗲𝗻𝘁𝘀 𝗖𝗼𝘃𝗲𝗿𝗲𝗱: By Type (Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Exclusive Provider Organization (EPO), and Others), By Payor (Private and Public), By User (Individual and Group), By Mode (Offline and Online), By Distribution Channel (Direct Sales, Agents, Brokers, Banks, and Others)

♦ 𝗚𝗿𝗼𝘄𝘁𝗵 𝗗𝗿𝗶𝘃𝗲𝗿𝘀: Rising Healthcare Costs and Growing Prevalence of Chronic Disorders to Boost Demand for Insurance Products | Increasing Insurance Premiums to Hamper Product Adoption in Market

➡️Competitive Landscape:

The global health insurance market is highly competitive, with several key players offering various insurance plans to meet the diverse needs of individuals and businesses. Leading companies, including UnitedHealth Group, Anthem, Cigna, and Aetna, are focusing on expanding their service portfolios and improving digital healthcare solutions. Mergers, acquisitions, and partnerships are common strategies adopted by these companies to strengthen their market position and enhance customer experience.

➡️List of Key Players Mentioned in The Health Insurance Market:

• UnitedHealth Group (U.S.)

• AXA (France)

• The Cigna Group (U.S.)

• CVS Health (U.S.)

• Ping An Insurance Group (China)

• AIA Group Limited (Hong Kong)

• Bupa Global (U.K.)

• Elevance Health (U.S.)

• China Pacific Insurance (Group) Co. Ltd. (China)

• Allianz (Germany)

➡️Segmentation Analysis:

The health insurance market is segmented based on provider type, coverage type, end-user, and region. The private insurance segment holds the largest share due to the increasing demand for customized healthcare plans and quicker claim settlements. Government-backed insurance programs are also expanding, ensuring coverage for low-income groups.

In terms of coverage type, individual health insurance policies dominate the market, driven by rising healthcare costs and increasing consumer awareness. Family floater plans are also gaining traction due to their affordability and comprehensive coverage benefits.

The corporate insurance segment is witnessing significant growth as employers offer group health insurance benefits to attract and retain employees. The growing gig economy has also increased demand for flexible health insurance plans tailored to freelancers and independent workers.

Regionally, the market is divided into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each with unique regulatory frameworks and demand trends. North America leads the market due to strong regulatory policies and high healthcare expenditure, while Asia-Pacific is growing rapidly due to expanding healthcare infrastructure and rising disposable incomes.

Browse Detailed Summary of Research Report with TOC:

https://www.fortunebusinessinsights.com/health-insurance-market-101985

➡️ Key Factors Driving the Health Insurance Market:

Several factors are fueling the growth of the health insurance market. The rising cost of medical treatments and hospital expenses has made health insurance essential for financial security. Government initiatives promoting healthcare coverage, such as the Affordable Care Act in the U.S. and Ayushman Bharat in India, have significantly increased insurance penetration. Additionally, the growing awareness of preventive healthcare and the demand for telemedicine services are driving the market forward.

➡️ Potential Growth Opportunities in the Global Health Insurance Market:

The increasing adoption of digital health platforms presents significant opportunities for insurers. The integration of artificial intelligence (AI) and big data analytics is helping companies personalize insurance plans and streamline claims processing. Furthermore, the expansion of microinsurance products in developing nations is opening new growth avenues, providing affordable healthcare coverage to low-income populations.

Regional Insights:

Geographically, North America dominates the global health insurance market due to well-established healthcare infrastructure, high healthcare costs, and strong regulatory frameworks. Europe follows closely, with countries like Germany and the UK investing in universal healthcare. The Asia-Pacific region is experiencing rapid growth, driven by increasing disposable income, government healthcare reforms, and rising awareness about health insurance benefits. Latin America and the Middle East & Africa are also witnessing growth due to improving healthcare infrastructure and policy reforms.

➡️ Recent Major Developments in the Global Health Insurance Market:

•November 2024 – Ping An Insurance partnered with Medtronic at the China International Import Expo (CIIE) with the aim of collaborating extensively on cardiac health chronic disease therapies to improve healthcare services.

•September 2024 – AU Small Finance Bank partnered with Niva Bupa, a health insurance company with the aim of offering health insurance products to their customers.

•September 2024 – Elevance Health acquired Indiana University Health Plans, Inc., which will operate as part of Anthem Blue Cross and Blue Shield in Indiana. The IU Health Plans provides Medicare Advantage plans to around 19,000 people across 36 countries globally.

Get a Free Sample Research PDF:

https://www.fortunebusinessinsights.com/enquiry/sample/health-insurance-market-101985

Read Related Insights:

Hong Kong Insurance Market Size, Share, Growth and Forecast, 2032

Pet Insurance Market Share, Growth, Report, 2032

About Us:

Fortune Business Insights™ delivers accurate data and innovative corporate analysis, helping organizations of all sizes make appropriate decisions.

Ashwin Arora

Fortune Business Insights™ Pvt. Ltd.

+1 833-909-2966

sales@fortunebusinessinsights.com

Visit us on social media:

Facebook

X

LinkedIn

Distribution channels: Insurance Industry

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release